Author: admin

-

Defer Federal & State capital gains taxes

•

When you utilize the 1031 Exchange option you will defer federal and statecapital gains taxes.

-

Return on Investment

•

Preservation of equity and estate planning is a benefit of investing in NNN Triple Net Property.

-

Guaranteed Income

•

Guaranteed Income is a benefit of a 1031 Exchange – You can sell your current property and receive passive income for 10-25 years when you own a triple net leased income property.

-

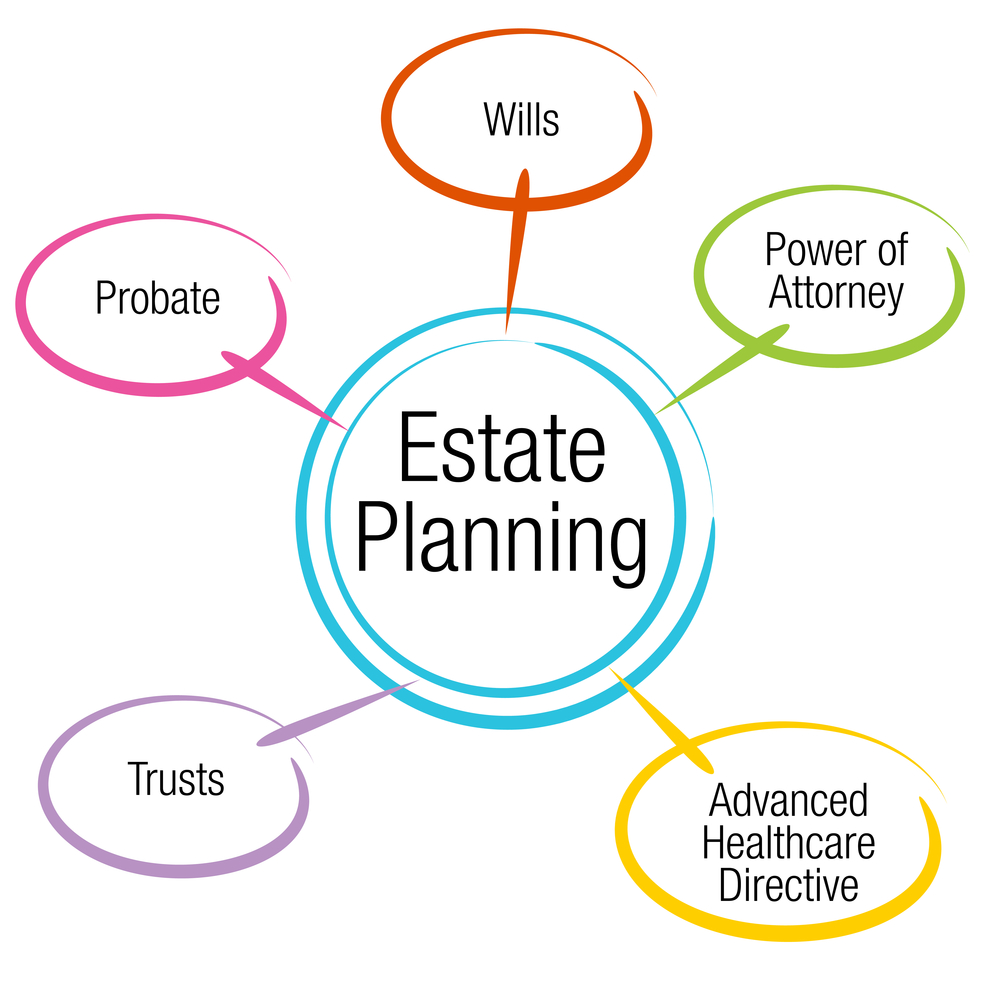

Estate Planning

•

Estate Planning is a benefit of a 1031 Exchange – Sometimes a number of family members inherit one large property and have different financial goals. Some family members want to continue holding the investment, others want to sell it immediately for cash. By exchanging from one large property into smaller properties,…

-

Eliminate Property Management

•

Eliminating Property Management is another benefit of a 1031 Exchange – Some investors accumulate several single family rentals, strip centers, shopping centers and/or apartments’ buildings. The ongoing maintenance and management of these property types is overwhelming for many investors and will be lessened by exchanging into single tenant NNN income producing…